Small and Medium-sized Enterprises (SMEs) are the engine of the UK economy - contributing c40% of all UK private sector employment and c50% of private sector turnover. Despite this, SMEs often encounter formidable challenges in securing the necessary financing to sustain and expand their operations. This article delves into the persistent disparities between SMEs and Large corporations in the UK and what we can do about it and in doing so better protect the UK economy.

Defining the gap

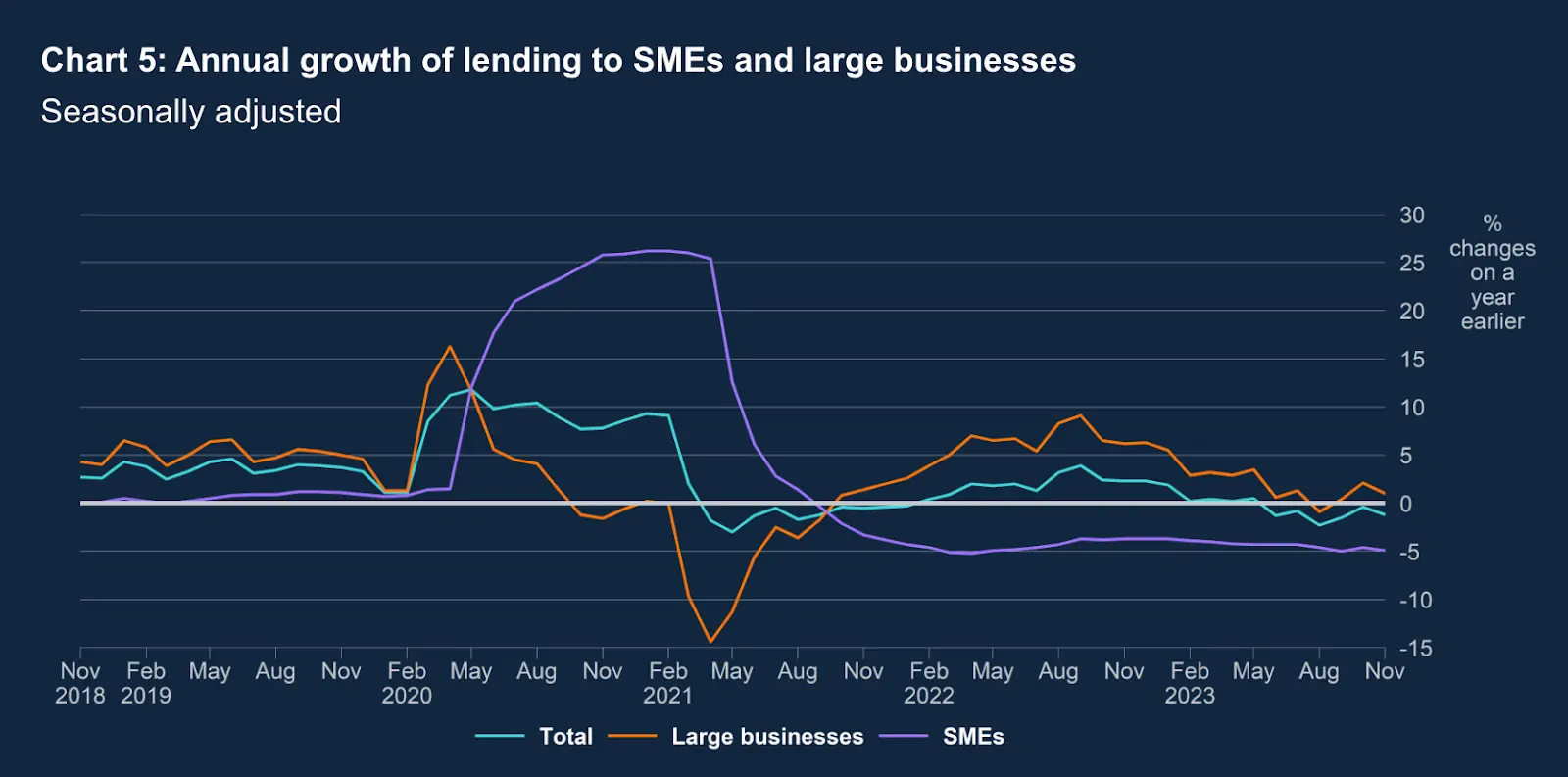

Recent data from the Bank of England highlights the enduring gap in access to debt services between SMEs and large corporations in the UK.

Chart: Annual Growth in Lending market, Source: Bank of England, 2023

Chart: Annual Growth in Lending market, Source: Bank of England, 2023

Since 2021 and the reduction of the various government-backed Covid schemes (CBILS, RLS, Furlough etc), SME lending has contracted 5% per year each year since. Conversely, Large businesses have seen credit grow as much as 10% but more recently remain stable.

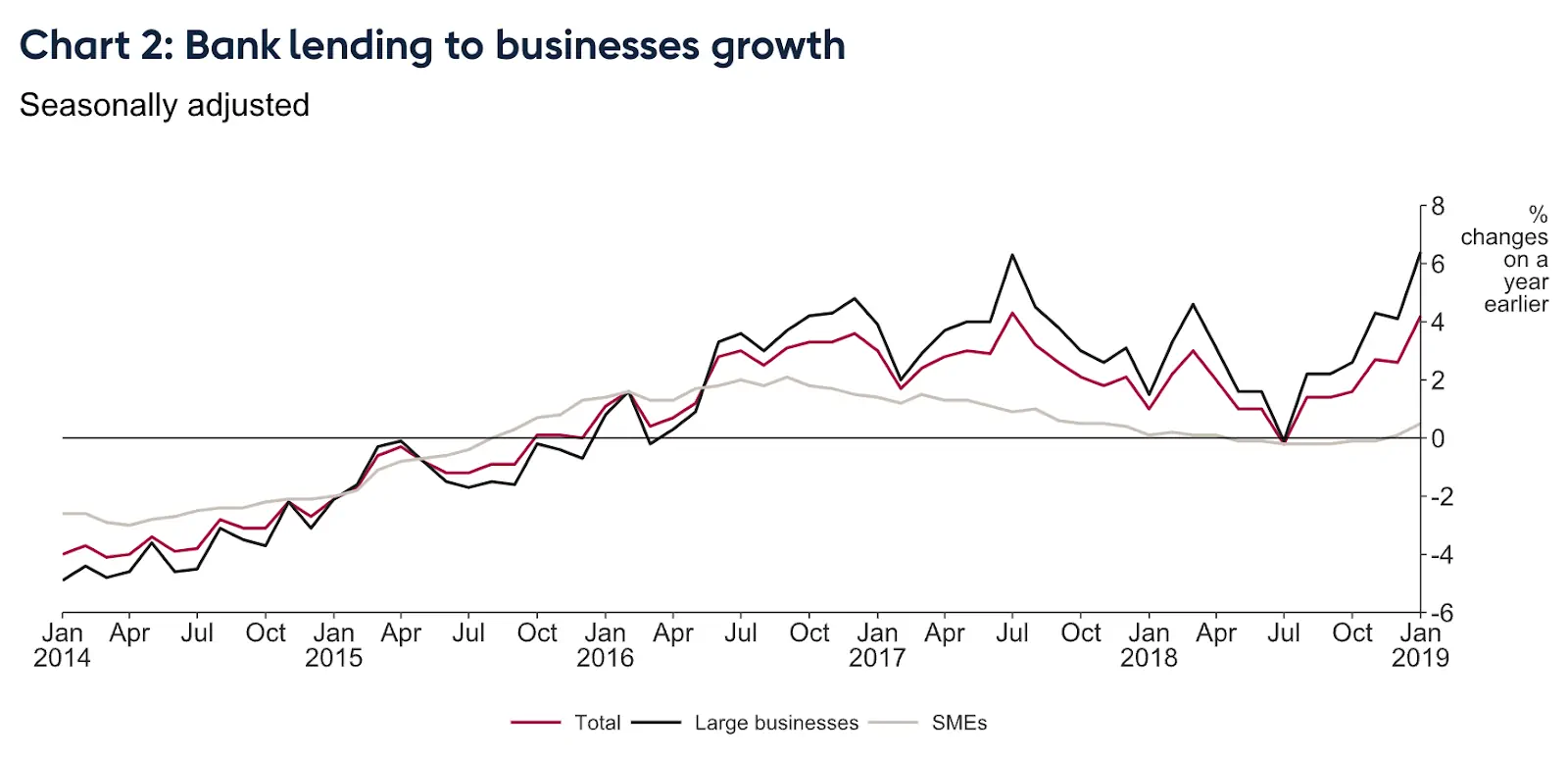

This is not a new phenomenon. Credit data published by the Bank of England in January 2019 (long before Covid skewed the landscape) documented a not dissimilar trajectory. The supply of Credit post-Global-Financial-Crash had broadly contracted through 2008-2014 but were improving year on year, with an overall growth in the Credit market seen from 2016. But the timing of Brexit caused

Chart: Annual Growth in Lending market, Source: Bank of England, 2019

Chart: Annual Growth in Lending market, Source: Bank of England, 2019

| Year | SMEs Approval Rate | Large Corporations Approval Rate |

|---|---|---|

| 2013 | 40% | 70% |

| 2023 | 50% | 75% |

Table: Comparison of Debt Financing Approval Rates Over Time Source: Bank of England Annual Reports

According to Dr. Emma Jones, an economist at the Institute of Economic Affairs, "The persistent disparity in access to debt financing reflects broader structural issues within the UK financial system, where SMEs often struggle to navigate complex lending criteria and stringent risk assessments."

Factors Contributing to Underservice:

Whilst there is no definitive list of factors, our research engaging with our panel of lenders, credit rating agencies and investors leads us to believe that the following remain key factors in why SME remain underserved:

- Awareness. The lending marketplace is complex, broad and changing regularly. According to the British Business Bank's annual SME Finance Monitor, SMEs continue to rely heavily on traditional bank financing, with 82% of SMEs applying for loans from high street banks. However, the approval rates for these loans remain relatively low, placing greater reliance on alternative sources of credit most SME of which are unaware of.

- Size matters when it comes to weathering the storm. Credit rating agencies and lenders are of the belief that larger more diversified business, often the recipients of public markets and investment funds, simply have more resilience when they face trading and market pressures.

- Limitation of data. SME are often younger businesses, with fewer proofing points and filing abbreviated financial statements. This limited depth of contextual data makes it difficult for institutions to make informed decisions about the circumstances and requirements of SME companies.

- Shallow collateral. Many lenders look to enhance the collateral they take as security for their loans when making facilities available to those deemed more risky. Large companies have more collateral and are supported by third party investors more commonly, SME on the other hand often have little beyond the security of their private assets outside of their business, this poses a significant barrier for SMEs, particularly in industries where capital investment is crucial for growth and innovation.

- Budgets. The biggest and best companies can afford the biggest and best advisors. The talent pool available to SME is inherently limited to regional and independent providers and constricted also by the availability of smaller budgets to support the investment of time to correctly diagnose, define and deliver an SMEs funding requirements.

What can we do about it and how can we help?

Collaboration with partners is key

According to Sarah Walker, CEO of the British Business Bank, "Improving access to finance for SMEs is essential for fostering a dynamic and competitive business environment in the UK. Addressing the systemic barriers faced by SMEs in accessing debt financing requires a concerted effort from policymakers, financial institutions, and the business community."

Dr. Richard Smith, a senior economist at the Confederation of British Industry (CBI), emphasizes the importance of collaboration in addressing the financing needs of SMEs: "Collaboration between financial institutions, policymakers, and the business community is essential for creating a supportive ecosystem that enables SMEs to access the financing they need to grow and prosper."

At Independence Debt Advisory we act as the bridge between SMEs and the lending community (comprising lenders, law-makers, lobbyists, investors and contractors)

- Our business is solely tailored to support SME businesses

- We are experts in the ever-changing debt landscape, holding relationships with many hundreds of lenders and thousands of products

- We are experts in using data and technology to solve and articulate SME requirements in a manner lenders will see value from

- With our team have multiple decades of experience building, growing and repairing lender businesses, we know how lenders work and what they need in order to progress and manage a client position successfully (for all)